Some Of Small Business Accountant Vancouver

Getting My Vancouver Accounting Firm To Work

Table of ContentsThe smart Trick of Pivot Advantage Accounting And Advisory Inc. In Vancouver That Nobody is Talking AboutGetting My Cfo Company Vancouver To WorkThe Ultimate Guide To Small Business Accountant VancouverGet This Report about Vancouver Accounting FirmNot known Incorrect Statements About Vancouver Accounting Firm An Unbiased View of Tax Accountant In Vancouver, Bc

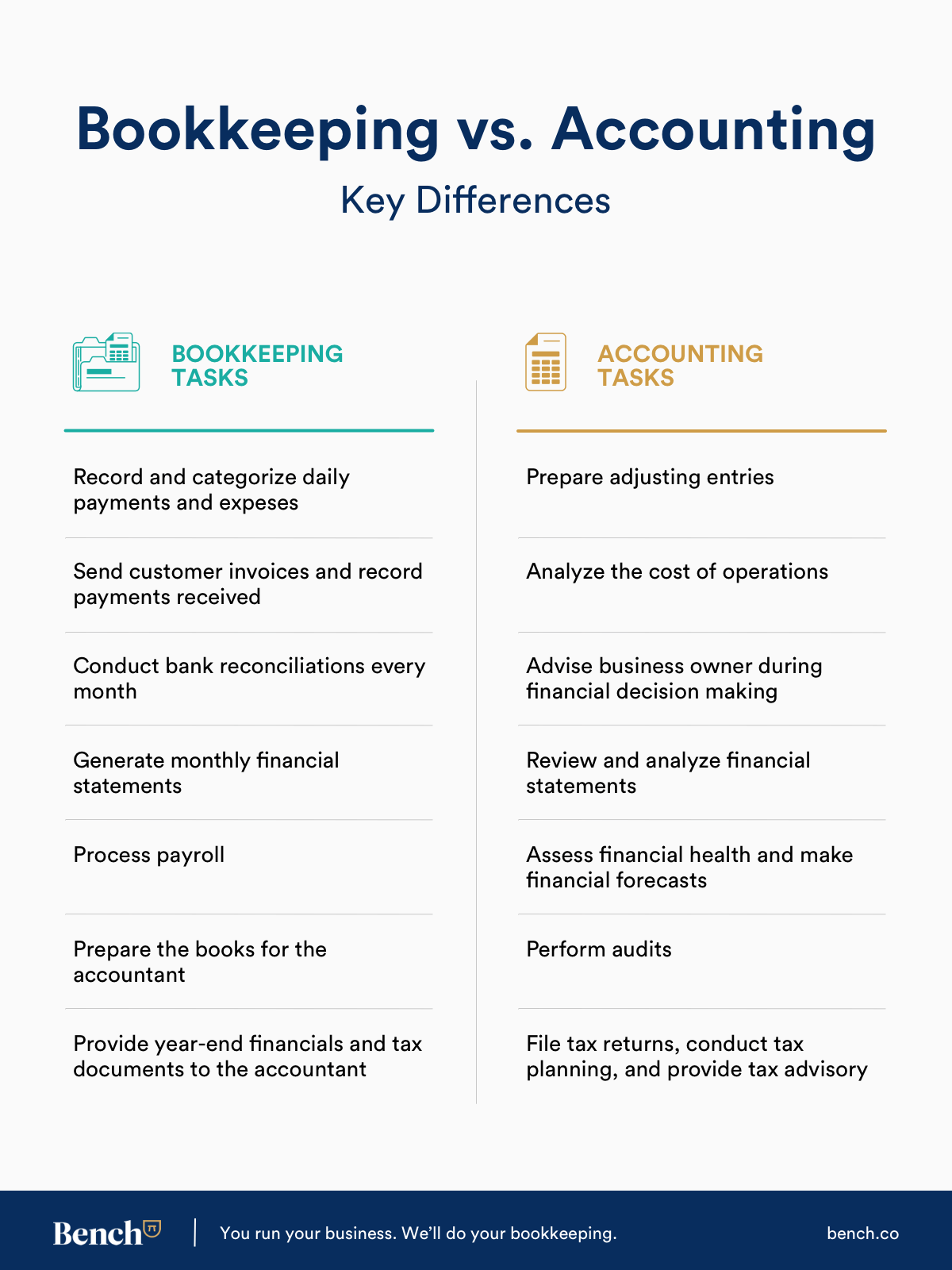

Here are some advantages to working with an accounting professional over an accountant: An accounting professional can offer you an extensive sight of your organization's economic state, together with methods and suggestions for making economic decisions. Bookkeepers are only responsible for recording economic deals. Accounting professionals are needed to finish more education, certifications and job experience than accountants.

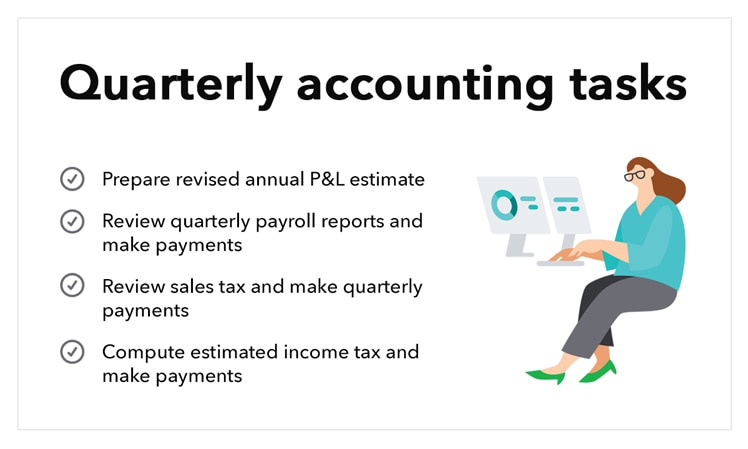

It can be difficult to determine the suitable time to employ an accounting specialist or accountant or to establish if you need one in any way. While numerous tiny services work with an accounting professional as a professional, you have several alternatives for handling financial jobs. For example, some tiny company proprietors do their very own accounting on software their accounting professional advises or makes use of, supplying it to the accountant on an once a week, monthly or quarterly basis for activity.

It may take some background research to discover an ideal accountant because, unlike accountants, they are not required to hold a specialist accreditation. A solid recommendation from a trusted colleague or years of experience are necessary variables when employing an accountant. Are you still uncertain if you require to work with a person to aid with your publications? Below are 3 circumstances that show it's time to employ an economic professional: If your tax obligations have ended up being too complex to handle by yourself, with numerous income streams, international investments, a number of deductions or various other considerations, it's time to employ an accounting professional.

What Does Outsourced Cfo Services Do?

For small companies, adept cash monitoring is a vital element of survival and also development, so it's important to deal with a financial specialist from the start. If you choose to go it alone, consider starting out with accountancy software application and also maintaining your publications meticulously up to day. That way, should you require to work with a specialist down the line, they will have presence right into the full financial history of your business.

Some source interviews were conducted for a previous version of this article.

A Biased View of Pivot Advantage Accounting And Advisory Inc. In Vancouver

When it involves the ins and outs of taxes, bookkeeping and also money, nevertheless, it never hurts to have a seasoned professional to resort to for support. A growing variety of accounting professionals are also dealing with points such as capital projections, invoicing and also human resources. Inevitably, several of them are taking on CFO-like duties.

Small company owners can anticipate their accountants to aid with: Choosing business framework that's the accountant movie images right for you is necessary. It influences just how much you pay in tax obligations, the documents you require to file and your individual obligation. If you're aiming to transform to a various service framework, it might result in tax repercussions as well as various other difficulties.

Also firms that are the very same size as well as sector pay very different amounts for audit. Prior to we obtain into dollar numbers, let's talk about the expenditures that go into tiny service accountancy. Overhead expenditures are costs that do not directly turn into an earnings. Though these expenses do not convert right into cash money, they are needed for running your service.

What Does Cfo Company Vancouver Do?

The ordinary cost of audit solutions for little service differs for each one-of-a-kind circumstance. The average regular monthly accountancy charges for a little organization will rise as you include much more services and the jobs obtain harder.

You can tape deals and process pay-roll using on-line software. Software services come in all shapes as click site well as sizes.

A Biased View of Vancouver Accounting Firm

If you're a brand-new company proprietor, do not fail to remember to factor accountancy expenses right into your budget plan. Administrative costs as well as accountant fees aren't the only accountancy expenditures.

Your time is additionally valuable and must be considered when looking at bookkeeping costs. The time invested on accountancy jobs does not create profit.

This is not planned as lawful recommendations; for more details, please go here..

Some Known Questions About Vancouver Tax Accounting Company.